As a retailer, you can use cluster profiling to describe your segmented customers based on the inputs you used for cluster analysis. You can use this information to develop product assortments and marketing strategies based on an in-depth understanding of the market. But what is the process of profiling your clusters after you’ve conducted a cluster analysis? And how should you interpret this information to optimise your business processes?

What is cluster profiling?

Have you ever wanted to understand shopper behaviour within a particular product category? Of course you do. And in reality, it’s not so much a nice-to-have but a must. You must have an insight into which customers are most profitable and which represent an opportunity for your business. Knowing who your customers are, understanding their behaviour, and satisfying their needs will give you a competitive advantage.

To do this, you can profile your clusters after you have run a cluster analysis. Profiling involves generating descriptions of the clusters with reference to the input variables you used for the cluster analysis. Profiling acts as a class descriptor for the clusters and will help you to ‘tell a story’ so that you can understand this information and use it across your business.

This approach is most useful where a multivariate cluster analysis has been conducted so that the clusters can be described from multiple angles and provide a more holistic description of your shopper’s behaviour. Once you have described and profiled each cluster, you can make inferences from the information provided.

For example, if you only have access to POS data, you would be able to assume the income group of the customers in the cluster based on the average spend per shopping trip, products purchased and brands purchased.

The goal of cluster profiling or segmentation is to achieve a clear description of who your customer is in each cluster, how you can meet their needs, and what you can do to achieve a return on your investment.

How to profile, interpret and understand your clusters

Let’s look at the example of loyalty data. You might want to take on what is known as an ‘RFM’ approach to cluster your market. RFM focuses on how recently your customer purchased from your store, the frequency of their purchase, and the monetary value of their basket spend.

This means that once you have clustered your customers, you can profile or describe them according to these criteria to understand their shopper behaviour. You can then use any gathered information to develop customer-centric assortment plans, targeted marketing strategies and tailored shopping environments to increase the turnover of your business and your customer’s satisfaction.

To profile, interpret and understand your clusters, you can follow the steps below.

Step 1

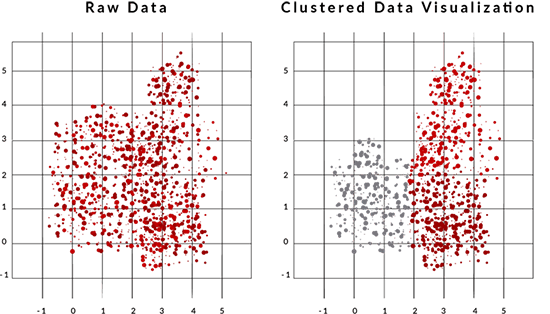

Graphically represent your clusters according to your input variables. As you can see in the example below, we have clustered the raw data according to purchase frequency and monetary value. This has produced three distinct clusters. The selected clustering algorithm aims to maximise the similarity between the data points in the same cluster and minimise the similarity between data points in different clusters.

Step 2

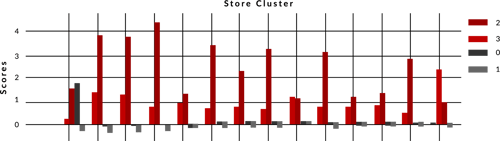

Score your clusters in a table so that you can measure and compare them on each input variable with regards to numerical or descriptive values.

Step 3

Now it’s time to profile your clusters. At this step, variables should be described in a type of ‘story’ about the category or customer base. This will help buyers and marketers to use this information strategically with an in-depth understanding of the differences between each cluster and which variables define the groupings. This step sets cluster profiling apart from traditional segmentation.

The output of this step is a clearly described set of clusters with a focus placed on the input variables. If you have access to a wider set of data, you can use other loyalty data to supplement the cluster profile even if it was not used in the original cluster analysis.

Next, you would need to build a ‘story’ or profile around each cluster so that you can use this information across your business and all your stakeholders can understand it. Below is an example of a profile based on the RFM approach to clustering.

Cluster 1

This cluster consists of emergency top-up shoppers. These consumers shop at the last minute for convenience-related products or items they have run out of. They have a small average spend per trip and may be more likely to shop at a convenience store.

Cluster 2

This cluster consists of weekly top-up shoppers. These consumers run a weekly shop where they purchase the products they need to last the week. They are more likely to plan their shopping trips and shop at a grocery store or general retailer.

Cluster 3

This cluster consists of monthly stock-up shoppers. These consumers complete a monthly shop where they purchase the products they need to last them for the month. They are likely to plan their shopping trips and shop at a hypermarket or discount retailer.

To complete a more accurate profile of the consumers in each cluster, you should supplement this information with demographic, psychographic and behavioural data. The addition of basket composition, LSM and loyalty information would also be beneficial.

When to implement cluster profiling in your business

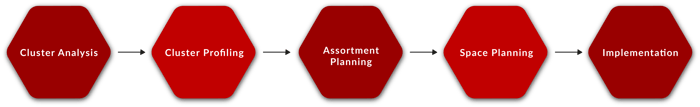

You should be implementing cluster profiling after undertaking a cluster analysis in your business. This follows a logical process whereby you should cluster and profile your data. Following this step, you can go about creating assortment plans for each cluster. You should also apportion floor and shelf space for each product category, after which planograms can be implemented.

This is important because your clusters are of no beneficial use if you don’t know what they mean and how the information can be used in your business. Below are a few areas that could benefit from cluster profiling in your business.

Assortment planning

Understanding the customers in each cluster will allow buyers to develop customer-centric product ranges tailored to their buying patterns, wants and needs. This is beneficial because your customers are likely to buy more and become loyal to your brand.

Meanwhile, your customers will benefit from this because you’ve been able to target them effectively and provide them with the products they actually want to buy. They, in turn, will believe that you’ve provided a personalised shopping experience and want to return.

Marketing

Your marketing team will be able to provide more targeted and effective marketing tactics to elicit a consumer response. Consumers within the same cluster are more likely to respond to an advertisement in the same manner. You can use this information to identify, attract and retain customers. You can also link marketing and loyalty programs to offer consumers within the same cluster similar products on promotion.

Conclusion

Cluster analysis is simple to implement in your business and identifies patterns within the consumer behaviour of your shoppers. This information can be profiled and used as an assortment planning and marketing tool to enhance operational efficiencies in your business. However, it is important to note that clustering is a dynamic process that needs to be updated and monitored according to changes in seasonality, the industry and customer behaviour to stay up to date and competitive.

Looking for assistance to profile and understand your clusters? Let DotActiv help. Find out more about our cluster optimization service or book a complimentary meeting with a DotActiv expert.